Introduction: Why Bajaj Finance Shares Plunged on June 16

Bajaj Finance shares stock started sharply lower on June 16, 2025, at approximately ₹956 per share—close to 90% lower compared to its last close of ₹9,331. The massive plunge, however, isn’t something to worry about. It is merely the technical adjustment from the company’s bonus issue (4:1) and a stock split (1:2). Although it might appear as a steep decline on the surface, the intrinsic value of investment by shareholders hasn’t changed.

Understanding the Bonus Issue and Stock Split

On April 29th, Bajaj Finance issued two corporate actions:

- Bonus Issue: 4 bonus shares for every 1 share held (4:1)

- Stock Split: From a face value of ₹2 to ₹1 (1:2 ratio)

These changes took effect from June 16, 2025, and trading resumed with the new share structure.

📊 Example Breakdown:

| Before Adjustment | After Bonus (4:1) | After Stock Split (1:2) |

|---|---|---|

| 10 shares | 50 shares (10 + 40 bonus) | 100 shares |

Therefore, a shareholder of 10 shares prior to the record date will now have 100 shares, though at one-tenth the cost, retaining the same total value of investment.

What It Means for Investors

The price decline is mathematically pure and not a decline in company fundamentals. The effective shareholding is enhanced through the bonus and split, so the stock becomes more liquid and available for new investors. Investors won’t lose any portfolio value unless the market itself responds negatively — something that hasn’t occurred here.

Key Takeaways:

- Adjusted share price for bonus & split, not because of performance.

- Total value of investment is not changed.

- Enhances trading volume and affordability.

ALSO READ: Samsung FT45 Series 27-Inch FHD IPS Monitor Review

Dividend Bonanza: ₹56 per Share Announced

Along with the split and bonus, Bajaj Finance announced:

- Final Dividend: ₹44 per share

- Special Dividend: ₹12 per share

➡ Total Dividend Payout for FY25: ₹56 per share

🗓️ Important Dates:

- Record Date (Final Dividend): May 30, 2025

- Payout: On or around July 28, 2025

- Record Date (Special Dividend): May 9, 2025

- Payout: On or around May 26, 2025

Bajaj Finance Q4 FY25 Results: Strong Financials Support Investor Confidence

The fundamentals are still good even with the adjustment in the stock. According to the April 29 Q4 FY25 results:

| Metric | Q4 FY25 | YoY Growth |

|---|---|---|

| Net Profit | ₹4,480 crore | 17% ↑ |

| Revenue from Operations | ₹18,457 crore | — |

| Assets Under Management (AUM) | Strong 26% growth | |

| New Loan Bookings | 36% ↑ YoY | |

| Net Interest Income (NII) | ₹9,807 crore | 22% ↑ |

These figures are better than analyst expectations and reflect strong demand for credit, lean operations, and healthy customer acquisition.

ALSO READ: Sceptre C248W-1920RN 24-Inch Curved Gaming Monitor Review

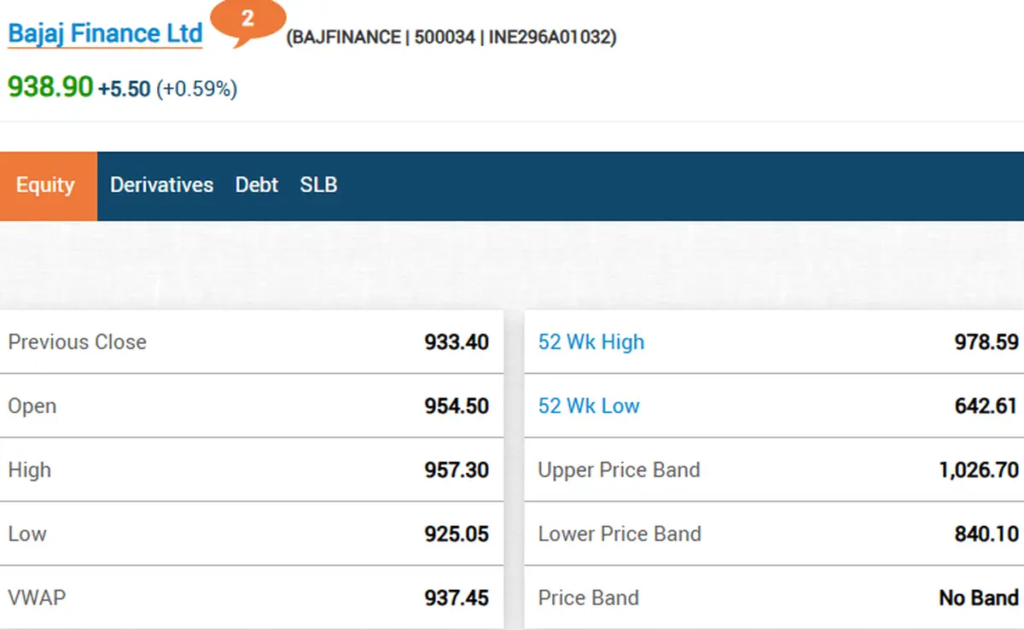

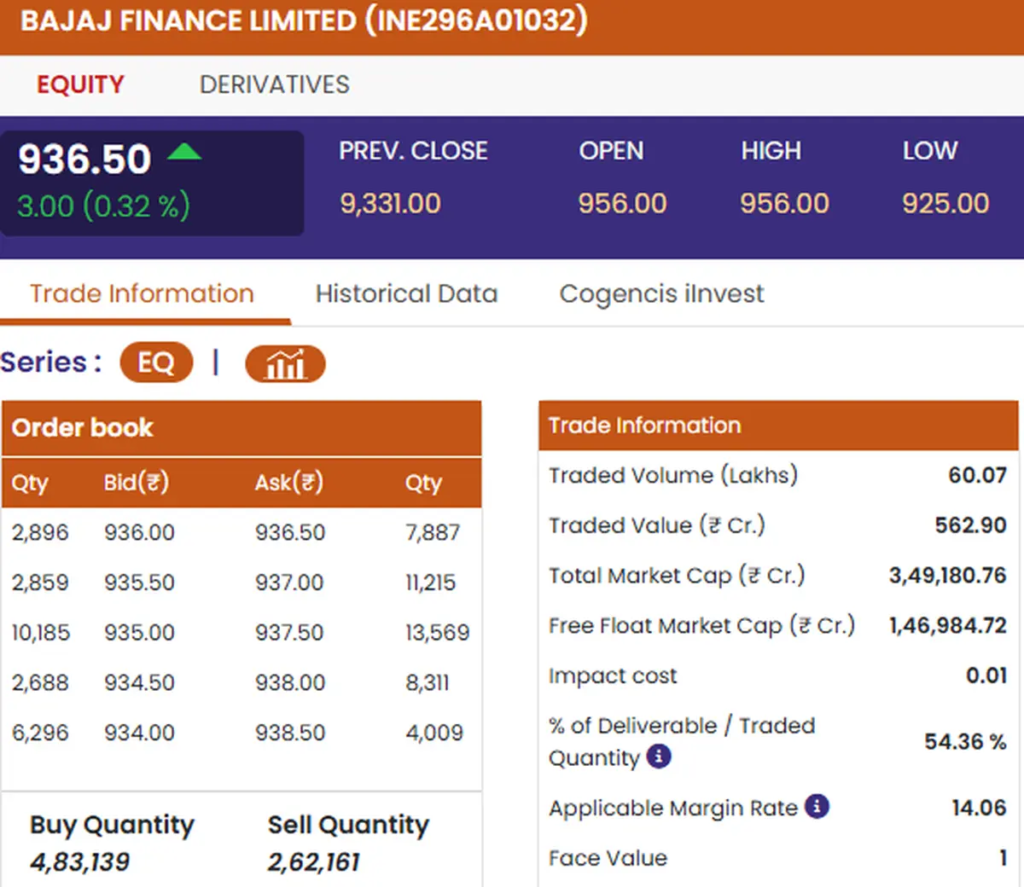

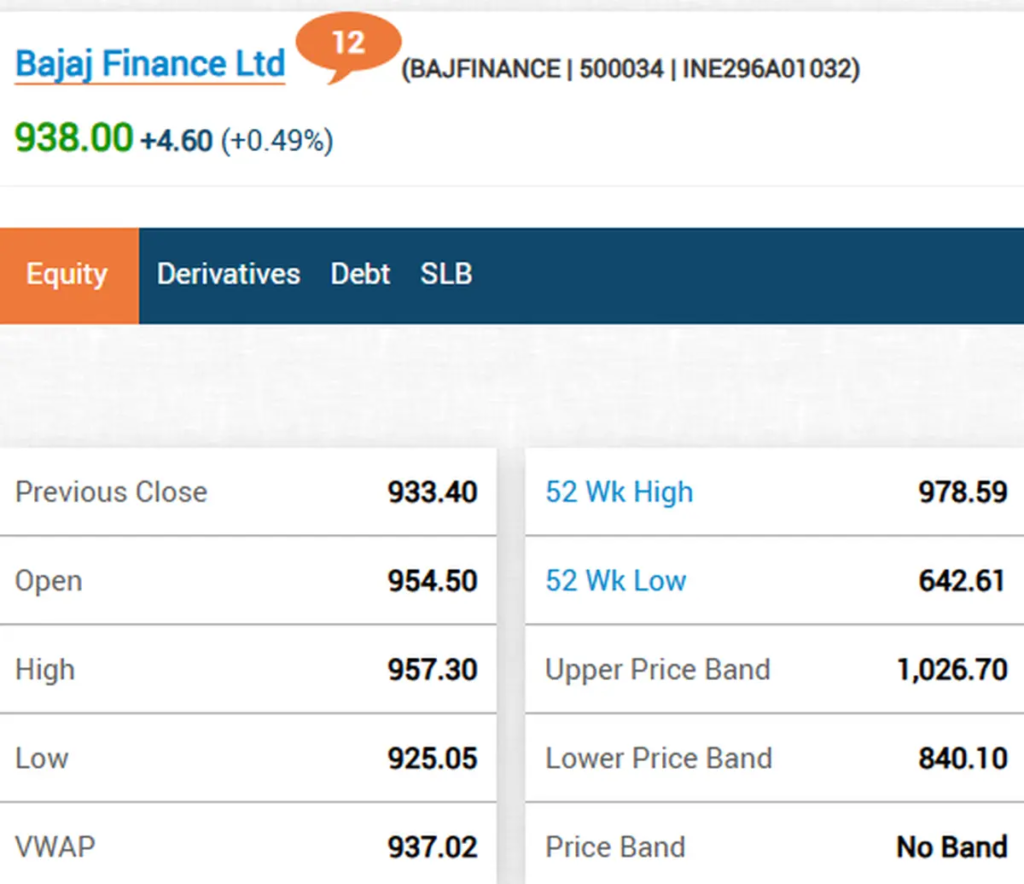

June 16 Market Summary: Stock Ends Flat Despite Adjustments

Post adjustment, Bajaj Finance started at ₹956, reached a high of ₹957.30 and a low of ₹925. Even though the huge price adjustment, it closed marginally positive at ₹938.90 on the BSE.

At the same time, larger indices such as Sensex (+677 pts) and Nifty 50 (+227 pts) closed on a high basis, bolstered by sharp outing in IT, realty, and metal sectors.

Should You Buy, Hold, or Sell Bajaj Finance Now?

The stock’s seeming fall is illusory—it’s an arithmetical correction. Bajaj Finance is still a high-quality NBFC with good fundamentals, healthy expansion, and shareholder-friendly measures like bonuses and dividend shares.

For long-term investors, this corporate action:

- Enhances liquidity

- Makes stock more affordable

- Reflects management’s confidence in business growth

Verdict: Ignore the 90% drop headline — the worth hasn’t gone missing. If anything, Bajaj Finance has improved for individual investors wanting to get in at lower per-share values with encouraging long-term benefits.